Understanding the Carbon Border Adjustment Mechanism

what is the Carbon Border Adjustment Mechanism?

You may have recently heard the term Carbon Border Adjustment Mechanism, or CBAM. But what is CBAM, what is a CBAM certificate and how is CBAM calculated? What industries and regions will be affected by CBAM regulations? And specifically, what will the effect of CBAM be on developing nations like South Africa? We are here to assist you with your CBAM calculations and CBAM reporting to enable your business to remain competitive in this changing global landscape.

Who can I speak to?

Sasha heads up our Advisory department and would love to support you.

What is CBAM?

CBAM is a tax levied on importers that accounts for the difference between the lower carbon tax that was paid when the product was produced in its country of origin, and the higher carbon tax that would have been paid had the product been produced in the EU. The aim of CBAM is primarily to prevent the EU’s climate efforts being undermined by carbon leakage, although it may inadvertently encourage the reduction of Greenhouse Gas (GHG) emissions in non-EU countries.

What is carbon leakage?

Carbon leakage describes the relocation of carbon-intensive production from countries with strict climate regulations to countries with lenient climate regulations. Carbon leakage also refers to replacing imported goods that originate from countries regulated with strict climate laws, with equivalent imported goods that originate from countries with lenient climate laws. In summary, carbon leakage is a change in the location of production of a particular item, or a change of the item itself, in order to reduce or entirely avoid carbon pricing mechanisms like carbon tax.

What is the foundation of CBAM?

Until now, carbon leakage in the EU has been mitigated through tax free allocations that have been granted to various industries. However, with the EU’s climate ambitions increasing, these allowances are being stripped away which will lead to an increase in carbon leakage. CBAM aims to prevent this carbon leakage.

CBAM is a key component of the EU’s Green Deal and Fit for 55 suite of legislation. The Fit for 55 programme seeks to reduce the EU’s GHG emissions by 55 % come 2030, and to achieve climate neutrality by 2050. Maria Scoppia, Director for Indirect Taxation and Tax Administration in the European Union, is one of the primary advocators for CBAM and her views can be heard in this informative video.

Is CBAM a carbon tax?

CBAM is not a carbon tax, as a carbon tax is levied by a government on its own industries. While CBAM may be administrated like a tax, and it is calculated based on the difference between two carbon pricing mechanisms, the EU have made it clear that CBAM is not a tax but rather an “environmental measure”.

A carbon tax typically drives industrial behavioural change and incentivises low carbon technologies. CBAM does not do this. CBAM aims to prevent carbon leakage from undermining the EU’s Emissions Trading Scheme (ETS), but does not aim to curtail GHG’s emissions itself. It is the ETS, not CBAM, that is intended to curtail carbon emissions.

Studies reveal that CBAM is unlikely to be an effective tool to motivate global GHG reductions. Rather global GHG reductions are best achieved multi-laterally through nations committing to Nationally Determined Contributions (NDCs) that are in keeping with their own climate ambitions and those reached at the Paris Agreement.

How will CBAM work?

Once fully implemented, CBAM will impose a carbon price on certain goods that are imported into the EU. This will ensure that imported goods are subject to the same carbon costs as goods that are produced in the EU. Goods that are produced within the EU will be subject to taxation under the ETS whereas goods produced outside the EU will be subject to CBAM in order to level the playing field.

Goods that are subject to CBAM are identified by their “CN code” which is the EU’s nomenclature for imported or exported products. The full list of CN codes that are subject to the CBAM regulations can be found in Annex 1 of the CBAM Regulations.

What products does CBAM regulate?

Presently, CBAM applies to 42 groups of goods in the following carbon-intensive sectors:

- Iron and steel

- Aluminum

- Fertilisers (including nitric acid and ammonia)

- Cement

- Electricity

- Hydrogen

In the future, CBAM will include other goods that are covered by the EU’s ETS. Organic chemicals and polymers were initially included in the draft CBAM regulations but were removed before finalisation. These are anticipated to be subject to CBAM soon. Other products will follow suit thereafter.

When will CBAM be implemented?

CBAM is being implemented in a phased manner. The first phase is the transitional phase which runs until the end of 2025. During the transitional phase importers of applicable goods are required to perform quarterly CBAM reporting only, and not to pay CBAM. This reporting is performed on the CBAM portal for Transitional Registries.

From the 01st of January 2026 the definitive phase will begin. This will require importers to purchase CBAM certificates corresponding with the GHG emissions embedded in their imported goods. Between 2026 and 2033, CBAM levies on imported goods will increase as the “free allocations” under the ETS for goods manufactured in the EU, are phased out.

How is CBAM calculated?

Firstly, one must determine if one’s products are subject to the CBAM Regulations. This may be done by carefully scrutinising Annex 1 of the regulations, and by consulting with Yellow Tree. Should one find that one’s products are subject to CBAM, one will need to calculate:

- Direct GHG emissions: These are emissions released from sources owned or controlled by one’s company, such as combustion and manufacturing processes.

- Embedded GHG emissions in qualifying raw materials: This refers to the GHGs generated throughout the lifecycle of a raw material, and these are also considered direct emissions under CBAM.

- Indirect GHG emissions: These encompass emissions resulting from the generation of electricity that is purchased by one’s company.

These GHG emissions must be calculated according to the CBAM methodology, and if one manufactures more than one type of product, GHG emissions must be appropriately allocated between products as per CBAM guidelines. To avoid the use of conservative default emissions factors for points 1 and 2 above, site-specific emissions factors can be determined through the measurement of relevant parameters. Please discuss this with our team at Yellow Tree.

Depending on who is designated as the “reporting declarant” under the CBAM regulations, GHG emissions must be communicated to either one’s importer or one’s indirect customs representative. The reporting declarant is responsible for submitting GHG emissions data to the European Commission quarterly during the transitional period. If one’s importer or customs representative has not yet started requesting GHG emissions data, they are likely to do so soon.

What is a CBAM certificate?

A CBAM certificate is purchased by the importer of goods into the EU, if those goods are regulated under CBAM (e.g. iron and steel, and aluminium). The value of the certificate represents the difference between the lower rate of carbon tax in the country of origin and the higher carbon pricing of the weekly EU carbon price.

Do other regions use CBAM?

While the EU’s CBAM is the first of its scale, California has applied a similar system since 2012, imposing an adjustment tax on certain electricity imports. Japan and Canada are also in the process of developing their own CBAM tax. The potential global adoption of border adjustment mechanisms underscores their significance as an international carbon pricing strategy.

What impact will CBAM have on Developing Countries?

The widening of the wealth gap is feared to be one of the unintended, but severe, consequences of CBAM. The argument is made that while developing countries and least developed nations (LDCs) often have very high carbon emissions intensities in the production of their exported goods, and will therefore be hard-hit by CBAM, these countries also have some of the lowest carbon intensities per capita. The carbon intensity per capita in developing nations is a mere 1 tonne of CO2e per person per year, whereas this value is five times higher in developed nations. The humanitarian argument is hence that the nation with the lower emissions intensity per person is being prejudiced, which is ironic. The EU maintain that CBAM is country agnostic, and is a tax on goods not nations or sources of goods. Relief to developing nations will have to be provided using mechanisms other than CBAM as CBAM does not differentiate based on country of origin.

Some developing countries such as India and Vietnam have responded to CBAM with a proposed export tax of the same value as CBAM. The goods that are exported will then be taxed at the same rate as CBAM when they leave the country of export. They are therefore not subject to CBAM upon entry to the EU. However, the tax is then recovered in the country of origin and can be used to strengthen and decarbonise those industries affected by CBAM. This is a forward-thinking approach, and one with which the EU is satisfied as it serves the purpose of preventing carbon leakage.

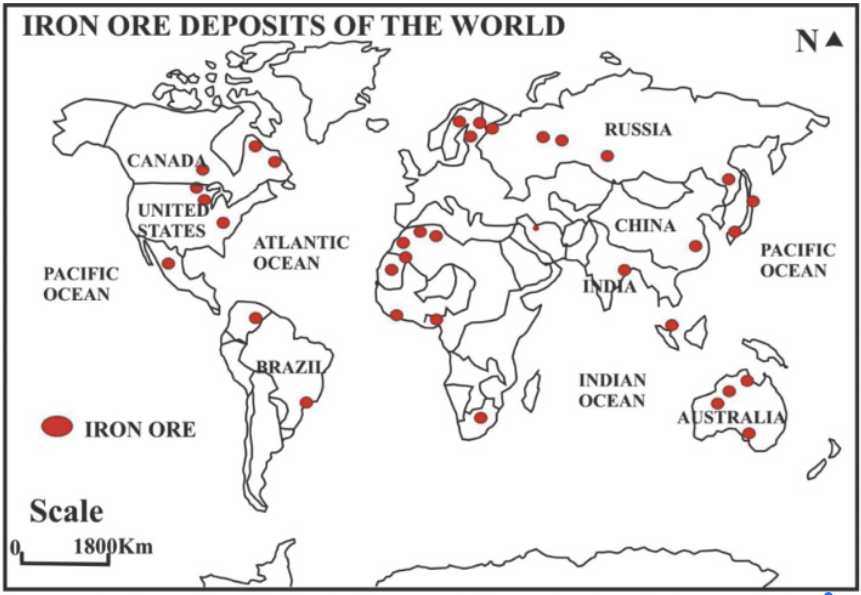

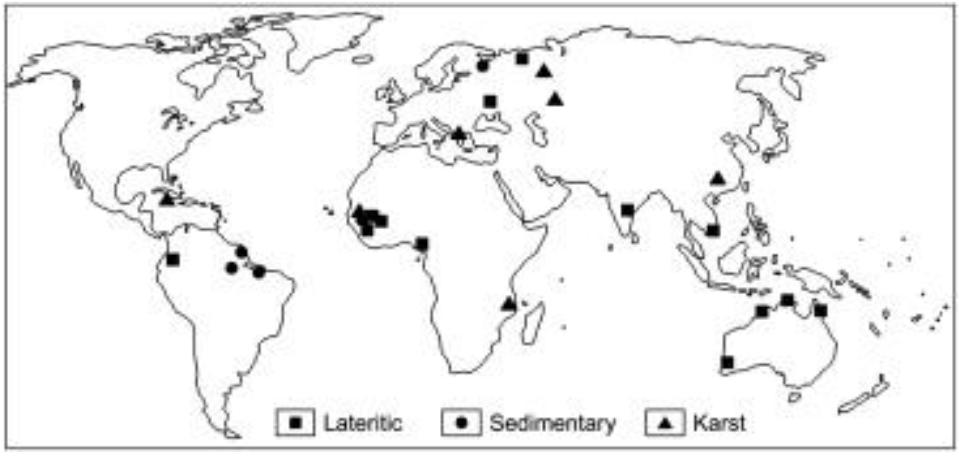

Global iron ore deposits are shown in the image on the left, while bauxite (the precursor of aluminium) deposits are shown on the right. Where these deposits lie in developing nations or LDC’s, where carbon pricing is either non-existent, or in its infancy, is where the greatest impact of CBAM will be felt:

What impact will CBAM have on South Africa?

The EU is one of South Africa’s largest trade partners. 21 % of all South African exports were destined for the EU in 2022. Trade and Industrial Policy Strategies (TIPS) estimates that 10.3 % of these exports, valued at 52.4 billion ZAR, will be subject to CBAM. The iron and steel sector will be most affected, followed by the aluminium sector. The fertiliser and cement sectors will not be as significantly affected as South Africa exports only low volumes of fertiliser and cement to the EU. More than 90% of the cement that is used in the EU is produced in the EU because the local cement industry is well-established. Currently, South Africa does not export electricity or hydrogen to the EU.

South Africa has one of the most carbon-intensive economies in the world. The high level of carbon that is embedded in South African production, combined with South Africa’s low effective carbon tax rate, means that CBAM will have a significant impact on South African businesses that export to the EU. The effective carbon tax price in South Africa in 2024 is a mere 3 USD per tonne of CO2e (assuming that the fossil fuel allowance and trade exposure allowance are both claimed). This will increase to 25 USD per tonne of CO2e in 2030, should the tax free allowances fall away. Due to the intricate nature of the EU’s ETS, it is difficult to estimate the European carbon price but it is estimated that it will be between 50 and 100 USD per tonne of CO2e in 2030. Consequently, the CBAM tax will be high for South African businesses which export to the EU due to the large difference between South Africa’s low carbon tax rate and the EU’s high carbon price.

Seeking examples further afield, Mozambique relies heavily on the export of aluminium and will be significantly affected by CBAM. Still further afield, 68 % of Morocco’s trade is with the EU, but fortunately only 3 % of these products are affected by CBAM at present, with fertiliser being the main one.

Will CBAM tax Scope 1 or 2 emissions?

In the definitive phase (i.e. from 01st of January 2026 onwards) when CBAM must actually be paid, products in the iron/steel, aluminium, and hydrogen sectors will only be subject to CBAM taxes based on their direct Scope 1 emissions, and not their indirect Scope 2 emissions (i.e. emissions associated with electricity generation). However, in the transitional phase that precedes the definitive phase, both direct and indirect emissions must be reported.

For those importing fertilisers, cement and electricity into Europe, both direct and indirect emissions will be subject to CBAM taxes in the definitive phase.

Who will pay CBAM?

The importer will pay CBAM by purchasing CBAM certificates.

What constitutes a successful CBAM?

Maria Scoppia noted wisely that a successful CBAM is one that no longer exists if exporting nations match the carbon tax price of the EU, leading to global carbon pricing parity.

With extensive expertise in GHG and carbon accounting, Yellow Tree’s chemical engineers are well-equipped to support you in determining your CBAM obligations and calculating your GHG emissions in accordance with the complex CBAM methodology. We are able to support clients around the globe with CBAM calculations, at competitive rates, so please contact us and let’s assess whether your products trigger CBAM.