Carbon Tax Act

What is the Carbon Tax Act?

The Carbon Tax Act No. 13 (Gazette No. 42483) was passed on Thursday the 23rd May 2019. Carbon Tax is a vessel through which South Africa can contribute to the global effort to stabilise greenhouse gas concentrations in the atmosphere and drive sustainable economic growth.

Through the Carbon Tax Act, the South African National Treasury is imposing taxes on local activities that release significant amounts of greenhouse gases. Additionally, the Carbon Tax Act rewards entities that use energy efficiently through the incorporation of tax-free incentives. The Carbon Tax Act aims to encourage investments in energy efficient, low carbon technologies.

The act will be phased in over several years. Phase 1 began on the 01st June 2019 and will run until the 31st December 2025. Phase 2 will run from from 2026 onwards. Phase 1 provides for generous allowances which will quickly fall away once Phase 2 begins. The carbon tax rate will rapidly increase so that a price of $30/tonne (R453.84 at the time of writing) is reached by the year 2030.

The Carbon Tax Act embraces the principle of “the polluter pays” where the costs of environmental damage must be paid by those who are responsible for harming the environment. In other words, the amount of carbon tax that a company is required to pay is dependent on the amount of greenhouse gases that are emitted.

Greenhouse gases refer to compounds that have a long term, harmful effect on the environment. When greenhouse gases are released into the atmosphere in large quantities, they act like a blanket over the earth’s atmosphere and trap heat from the sun. This trapped heat causes the earth’s temperature to rise. This phenomenon is referred to as global warming.

WHAT POLLUTANTS DOES THE CARBON TAX ACT REGULATE?

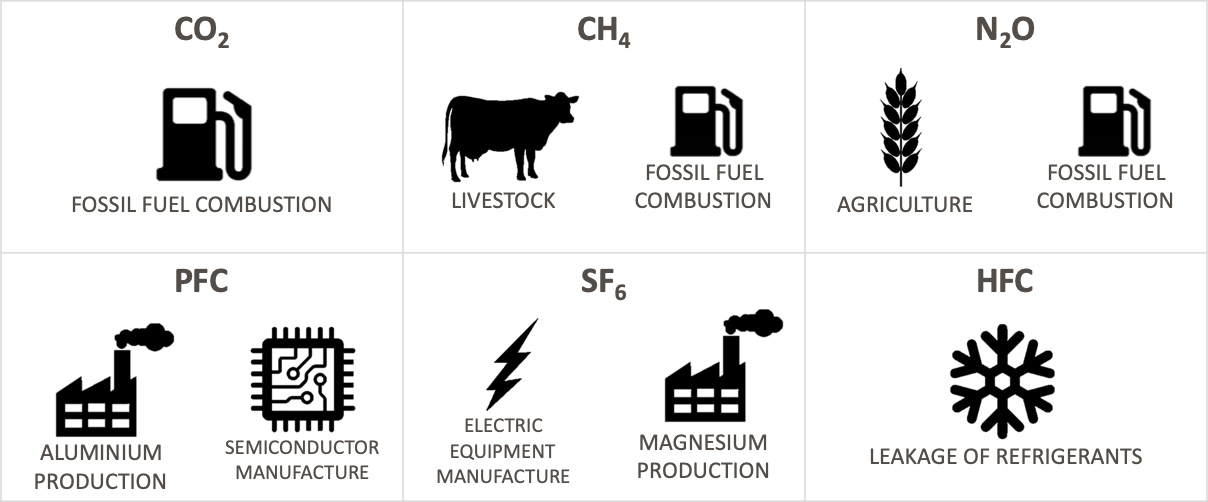

There are many greenhouses gases, however, the Carbon Tax Act recognises six main greenhouse gases that are emitted from industrial activities. These are Carbon Dioxide (CO2), Methane (CH4), Nitrous Oxide (N2O), Hydrofluorocarbons (HFC’s), Perfluorocarbons (PFC’s) and Sulphur hexafluoride (SF6). Some of these gases cause more global warming than others.

The Six Regulated Greenhouse Gases and their Sources

WHICH POLLUTANTS ARE MOST HARMFUL?

Each greenhouse gas causes a varying degree of harm to the atmosphere when compared to CO2. This degree of harm is referred to as the Global Warming Potential (GWP) of a greenhouse gas. Every greenhouse gas has its own GWP factor that was developed by the Intergovernmental Panel on Climate Change (IPCC).

For example, 1 kg of methane causes 23 times more global warming than 1kg of CO2. And 1kg of sulphur hexaflouride causes 22 200 times more global warming than 1kg of CO2. Carbon Tax regulates six pollutants and the table beneath shows how detrimental each of these is:

To calculate a factory’s total greenhouse gas emissions, the quantity of each greenhouse gas (kg/year) is multiplied by its GWP factor and these six numbers are summed. This total is called the “Carbon Dioxide Equivalent” or CO2e.

WHERE DO THE POLLUTANTS COME FROM?

Fuel combustion emissions

Most factories in South Africa burn fuel such as gas, coal, HFO or wood to create heat, which is used in the manufacturing of products. These fuels are burned in combustion appliances such as boilers, furnaces, kilns, and incinerators. Greenhouse gases are released during this combustion.

Industrial process emissions

In addition to the emissions from combustion appliances, greenhouse gases are also released from the manufacturing processes themselves when raw materials are chemically or physically transformed into products. Common manufacturing processes include cement manufacturing, steel making and the petroleum industry. Pollutants from both the combustion of fuel and from manufacturing are typically emitted into the atmosphere via chimney stacks.

Fugitive emissions

Greenhouse gases can escape a process when they are not meant to do so, such as through leaks, evaporation, materials handling, expansion and contraction. These are referred to as fugitive emissions. Common sources of fugitive emissions include mines and the processing and transportation of liquid fuels.

WHO DOES CARBON TAX APPLY TO?

EXAMPLES OF ACTIVITIES THAT ARE ELIGIBLE FOR CARBON TAX

How much Carbon Tax do I pay?

The amount of Carbon Tax is calculated by multiplying the carbon dioxide equivalent by the current rate of tax:

The tax rate is set to increase by CPI each tax year.

WHAT ARE TAX-FREE ALLOWANCES?

How do I register?

Companies have to be licensed and register as manufacturing warehouses according to the Customs and Excise Act. Our Carbon Tax consultants can walk you through this process.

| Allowance | Overview | Percentage |

| Fossil Fuel Combustion Emissions | For fuel combustion activities. | 60% |

| Industrial Process Emissions | For industrial process activities. | 60/70% |

| Fugitive Emissions | Activities releasing fugitive emissions. | 10% |

| Trade Exposure | Based on exports, imports and total production. | 0-10% |

| Performance | For above-average emissions performance. | 0-5% |

| Carbon Budget (2022 and prior) | Participation in phase 1 of the Carbon Budget System. | 0-5% |

| Offset | Provides additional flexibility to reduce GHG emissions. | 0-10% |

Meet our Consultants

Caitlin

BSc Chem Eng, LLM

Caitlin

BSc Chem Eng, LLM

When do I need to pay my Carbon Tax?

How can Yellow Tree help you?

IDENTIFY

Our chemical engineers will determine all sources of greenhouse gas emissions on site.

Calculate

We will determine the total greenhouse gas emissions, the total carbon tax liable, and apply tax-free allowances.

Recommend

We will make technical recommendations to reduce GHG emissions and increase tax-free allowances.