Carbon Tax in South Africa: Recent Developments

Carbon Tax is a relatively new addition to South Africa’s business landscape. As such, it continues to evolve and develop. This article highlights some of the changes that have transpired since last year’s carbon tax filing season.

1. On-site SARS Audits: The South African Revenue Service (SARS) now routinely conducts on-site audits. These audits involve excise auditors observing site activities and asking questions. It is critical for company personnel to be knowledgeable in greenhouse gas (GHG) reporting and carbon tax in order to host SARS during these audits. It is beneficial to have an experienced GHG and carbon tax consultant present at the audit to support one in answering questions.

2. Stringent Enforcement Measures: SARS has begun issuing severe penalties for non-compliance with the Carbon Tax Act and the Customs and Excise Act. These non-compliances include:

a) Discrepancies in Reporting: Differences between the fuel combustion figures and GHG emissions declared to SARS and those declared to the Department of Forestry, Fisheries and the Environment (DFFE) as part of mandatory GHG reporting under the National Greenhouse Gas Emissions Reporting Regulations (NGERs).

b) Unsupported Allowance Claims: Claiming allowances without appropriate supporting documentation.

c) Late Filing: Filing carbon tax returns after the deadline.

d) Late Payment: Delayed payment of the tax payer’s carbon tax liability.

The penalties levied by SARS for late filing and payment are substantial, amounting to 25 % of the amount owed for each infraction. Additionally, interest on the amount owing is charged at the rate specified in SARS’ interest rate tables. Since the 01st of September 2023, this rate has been 11.75 % per annum. In recent months, Yellow Tree has witnessed several companies being charged penalties in the order of millions of Rands.

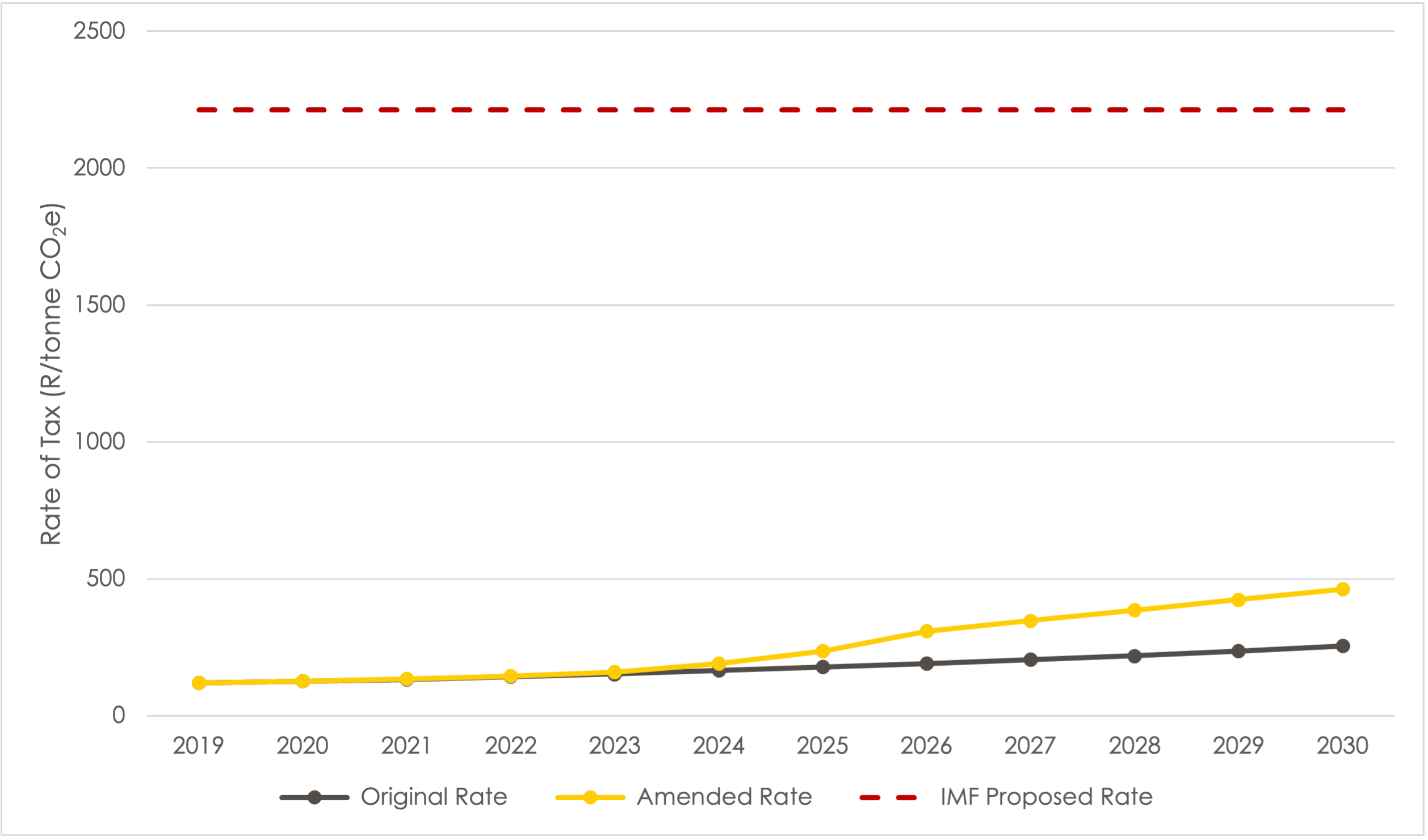

3. Concern regarding tax rate increases: On the 05th of January 2023, the Minister of Finance announced a series of carbon tax rate increases spanning until 2030, aiming for 20 USD per tonne of CO2e by 2026 and 30 USD per tonne by 2030.

Prior to this, the carbon tax rate was set to increase only moderately by the Consumer Price Index (CPI) plus 2 % until the end of 2022, and by CPI thereafter. However, research released by the International Monetary Fund (IMF) in June 2023 suggests that a carbon tax rate of 120 USD per tonne of CO2e must be reached by 2030 for South Africa to meet its Nationally Determined Contribution (NDC) under the Paris Agreement. Currently, the carbon tax rate is just 10 USD per tonne of CO2e, meaning that further increases in the carbon tax rate are almost certain in the coming years.

The graph beneath shows the years 2019 to 2030. The original carbon tax rates that were promulgated in 2019 are displayed by the grey line. The amended rates that were promulgated in January 2023 are shown with the yellow line and are the prevailing rates at present, and the rate that was proposed for South Africa by the IMF is indicated by the red line.

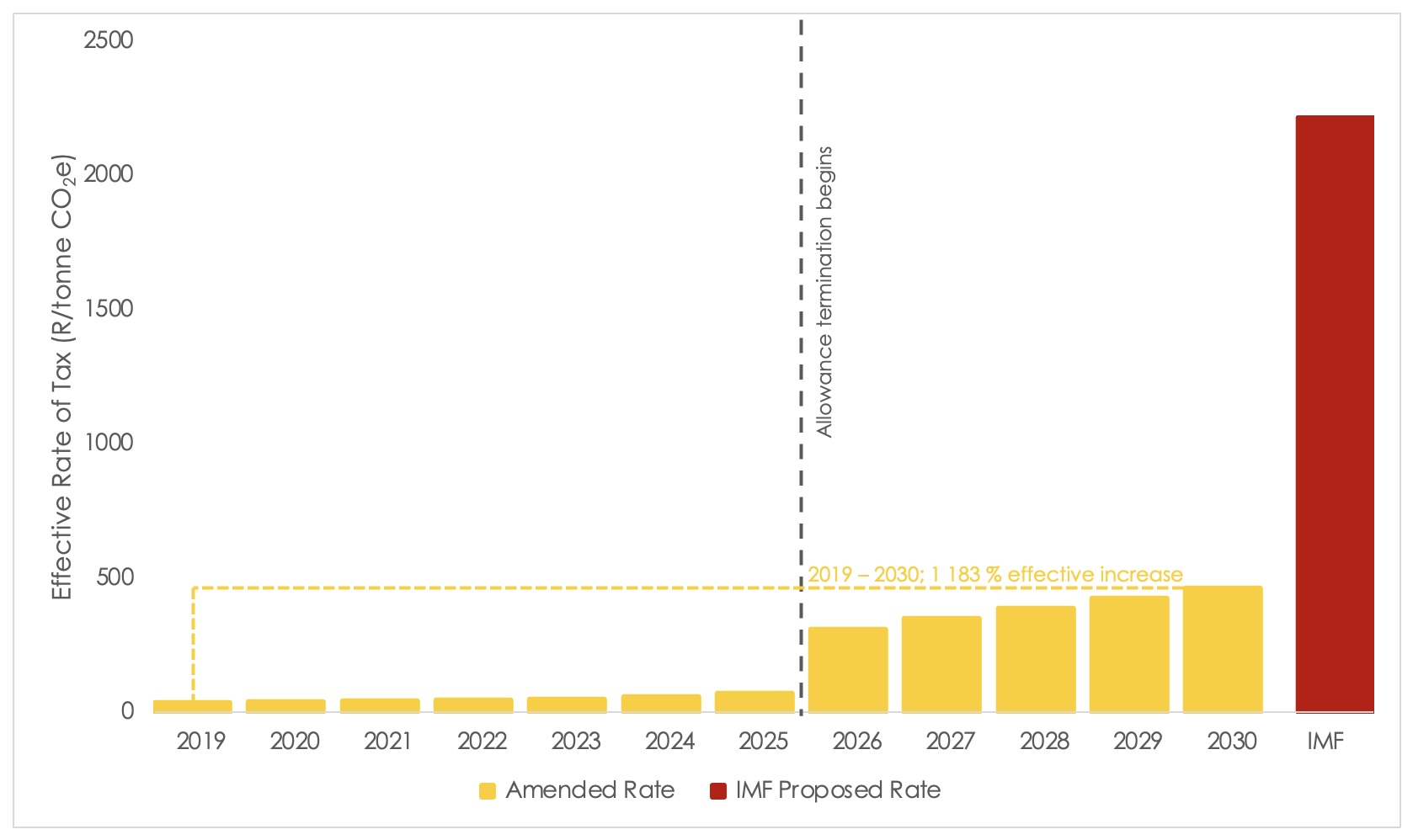

5. Phasing Out of Allowances: Phase 1 of carbon tax will conclude at the end of 2025. At that point, the tax allowances that have provided relief during the first phase will begin to be phased out. These generous allowances have meant that the effective carbon tax rate has been much lower than the headline carbon tax rate (which is presently R159/tonne CO2e for the Jan-Dec 2023 year and will be R190/tonne CO2e for the 2024 year).

Ambiguity in the 2022 budget speech when compared to the 2022 Budget Review created uncertainty about whether these allowances would be removed rapidly or gradually. The graph below shows the increase in the effective tax rate, should the allowances fall away completely after Phase 1 ends in 2025. Between 2019 and 2030, there will have been a 1 183 % increase in the effective carbon tax rate with the assumption that a 60 % basic tax-free allowance and a 10 % trade exposure were initially claimed and that these two allowances fall away entirely after 2025.

6. Border Adjustment Mechanisms: Carbon tax represents one approach among several in carbon pricing. Another significant mechanism, the border adjustment mechanism, addresses carbon-intensive imports into regions. The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM), introduced in January 2024 and set for full implementation in 2026, will impose a carbon price on specific imported goods including cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen products. This will ensure that these items carry equivalent carbon costs to those produced within the EU thereby curbing “carbon leakage”. Carbon leakage is the shift of production to regions with more lenient Greenhouse Gas emissions regulations.

While the EU has pioneered the implementation of CBAM, other developed nations such as the US, Canada, the UK, and Japan, are exploring similar mechanisms. The potential global adoption of border adjustment mechanisms underscores their significance as an international carbon pricing strategy. South African exporters need to monitor CBAM closely as it will likely augment in the years ahead to incorporate more commodities, raw materials and finished products.

In conclusion, as South Africa’s carbon tax framework continues to evolve, businesses must be vigilant and adapt to the changing landscape. Recent developments include stricter enforcement measures, imminent tax rate increases, and border pricing mechanisms such as CBAM aimed at levelling the playing field. Remaining informed and proactive in compliance efforts will be crucial for navigating the complexities of carbon taxation and remaining competitive in a shifting global market.

Yellow Tree continues to stay abreast of these developments. Please do reach out to us to discuss your company’s carbon tax, compliance and simultaneous permissible tax mitigation, decarbonisation, and CBAM. Our team of chemical engineers is here to help.