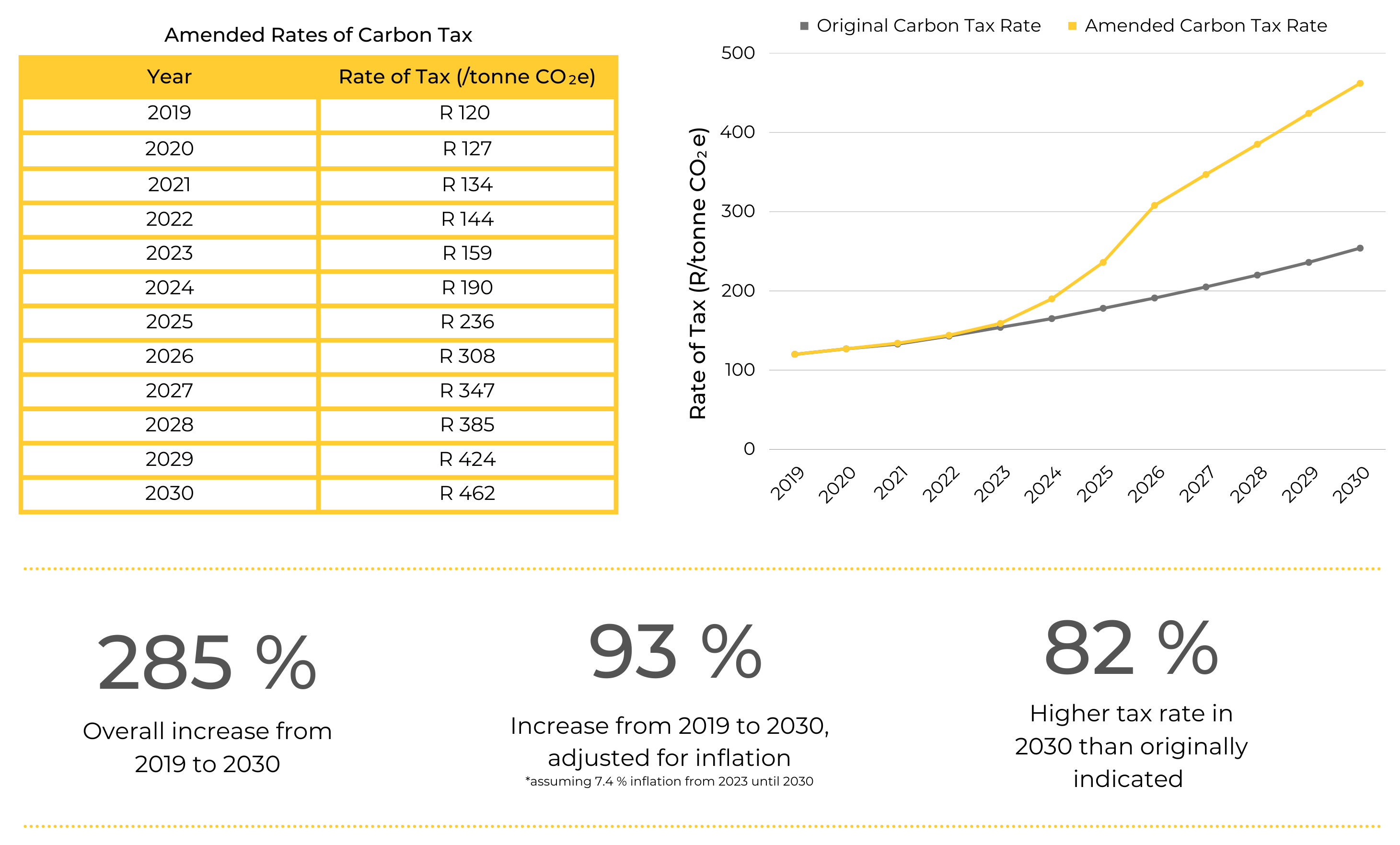

Carbon Tax set to Increase by 285%

What you need to know

On the 05th of January 2023, the Ministry of Finance announced South Africa’s amended carbon tax rates spanning 2023 to 2030. Prior to this, the carbon tax rate was set to only increase by the Consumer Price Index (CPI) plus 2 % until the end of 2022, and by CPI thereafter.

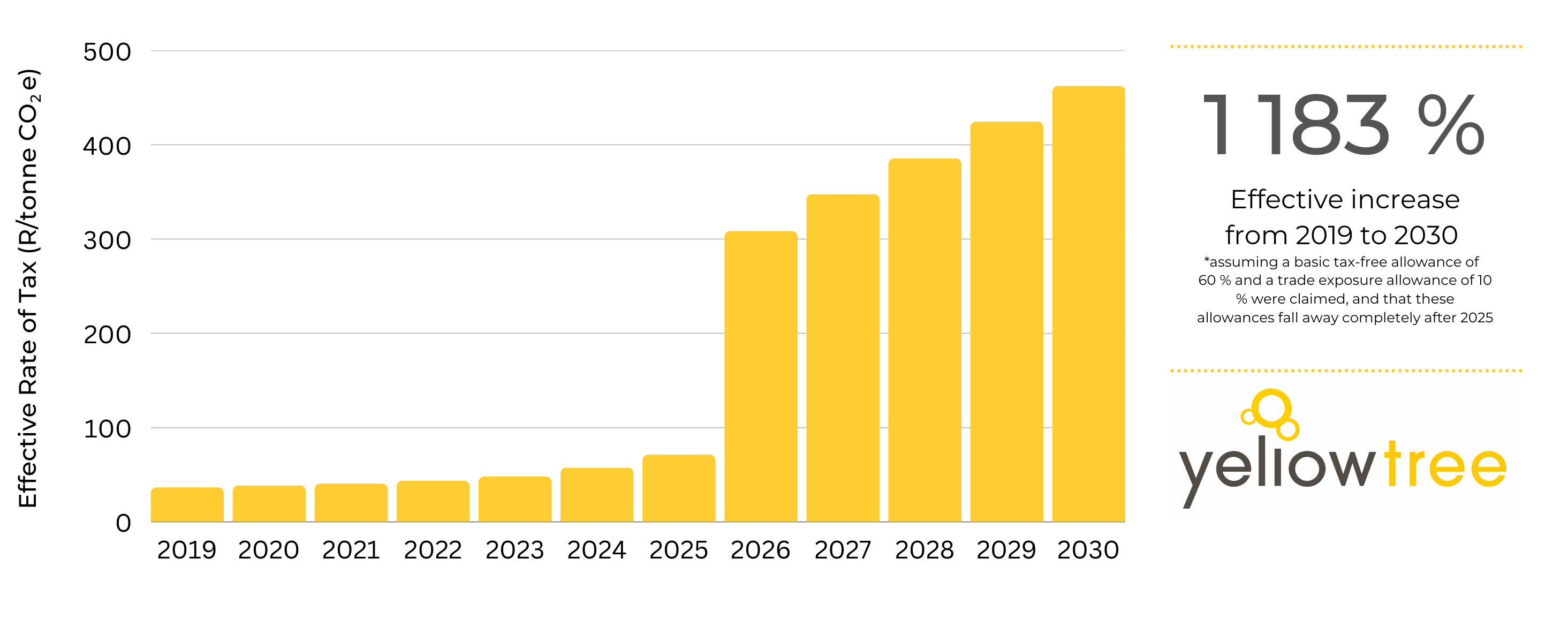

In addition to significant increases in the rate of tax, government has indicated that the tax allowances, which have provided respite in the first phase of carbon tax, may fall away when Phase 1 ends on the 31st of December 2025. At this time, it is not known whether these allowances will cease to apply immediately, or whether they will be phased out gradually.

These allowances have enabled taxpayers to reduce their carbon tax payments by up to a maximum of 95 %. Most manufacturing businesses that burn fossil fuels have not been able to claim the maximum of 95 %, but will have enjoyed a 60 % basic tax free allowance, along with a 10 % trade exposure allowance. Because of these allowances, the effective rate of tax from 2019 to 2025 has been significantly lower than the rates shown in the table above. Thus, the effective increase in the rate of tax after 2025 will actually be much higher than indicated above if these allowances do fall away. This is shown in the graph below.

In light of these profound increases, it is critical that taxpayers reduce their carbon tax liability.

Do you calculate your own carbon tax?

Are you sure that you are optimising the available allowances?

Would you like our team of experts to review your, or your consultants’, calculations to give you peace of mind?

Yellow Tree has saved its clients hundreds of thousands of Rands by performing or reviewing their carbon tax calculations. We would love to give you the same peace of mind. So please contact us!