Carbon Tax Allowances

South African Industry has come to terms with the fact that carbon tax will remain a part of our future and as such, it is important that we all understand how to make use of the allowances in the Carbon Tax Act to reduce the cost of the tax.

Before reading further, if you need to refresh your knowledge of carbon tax you can read this insightful article on the subject.

As you will note in the article above, every tonne of Carbon Dioxide equivalent (CO2e) that is emitted to the atmosphere, is priced:

To reduce the burden on South African industry, the pricing above has been significantly discounted (by between 60 and 95 %) through the application of 7 different allowances, resulting in a final price of between R 6 and R 48 per tonne of CO2e. This begs the important question:

Why set the price of carbon tax and then discount it so significantly?

We have to properly understand the answer to this question before we delve into the 7 allowances and how to apply them to determine a taxpayer’s carbon tax obligation.

The price of carbon tax was determined by economists to account for the Rand value of the damage to our economy that arises from the emission of one tonne of CO2e into our atmosphere. The release of carbon dioxide contributes to global warming, changes in rainfall patterns, water shortages, increased incidences of fire, and to the spread of disease. This puts strain on the national health system, harms communities, constrains food supply and disrupts agriculture and business.

It is possible to build a macro-economic model that attaches a price to the economic cost of global warming, and to then divide this total cost by the quantity of CO2e emissions that inflicted the damage, so as to obtain a price per tonne of CO2e. This is how the pricing, shown in the table above, was obtained. It would be misleading for government to price the damage to the economy at any value other than its true cost to us as a nation.

Policy makers were then faced with the challenge of addressing the affordability of the tax. They needed a way to introduce the tax gently, to not stifle economic growth, and to provide industry with time to implement low-carbon technologies. This has been achieved through discounts, known as allowances.

It is also important to remember that allowances provide a less contentious mechanism by which to later increase the price of the tax. It is easier to reduce or remove the allowances, than to increase the price per tonne of CO2e.

Furthermore, allowances communicate that the true value of a tonne of CO2e is as per the table above. Allowances create affordability, provide price certainty, and do not water down the true cost of a tonne of CO2e to the economy.

What Allowances are there?

There are seven allowances. The first three, which are shown in yellow beneath, are very simple to apply. Schedule 2 at the back of the Carbon Tax Act lists the various sectors that must pay carbon tax and then provides these sectors with either a fossil fuel, industrial process or fugitive emissions allowance to immediately reduce the cost of the tax. One merely has to consult Schedule 2, to obtain the first three allowances that are shown in yellow beneath.

a) Allowance for fossil fuel combustion emissions: 60%

b) Allowance for industrial process emissions: 60-70%

c) Allowance for fugitive emissions: 10%

d) Trade exposure allowance: 10%

e) Performance allowance: 5%

f) Carbon budget allowance: 5%

g) Offset allowance: 10%

The latter four allowances above are more complex, and this article will explain these in simple terms. However, please do contact us to support you in verifying your allowances, as errors will be costly and it is prudent to seek the support of process engineers who intimately understand the legislation.

Trade Exposure Allowance Regulations

The trade exposure allowance regulations were passed on the 19th of June 2020 as Government Notice (GN) 690. These were created to protect South African exporters from being less competitive in the global economy. Of course, they will only be less competitive until such time as carbon tax is adopted globally and the playing field is levelled.

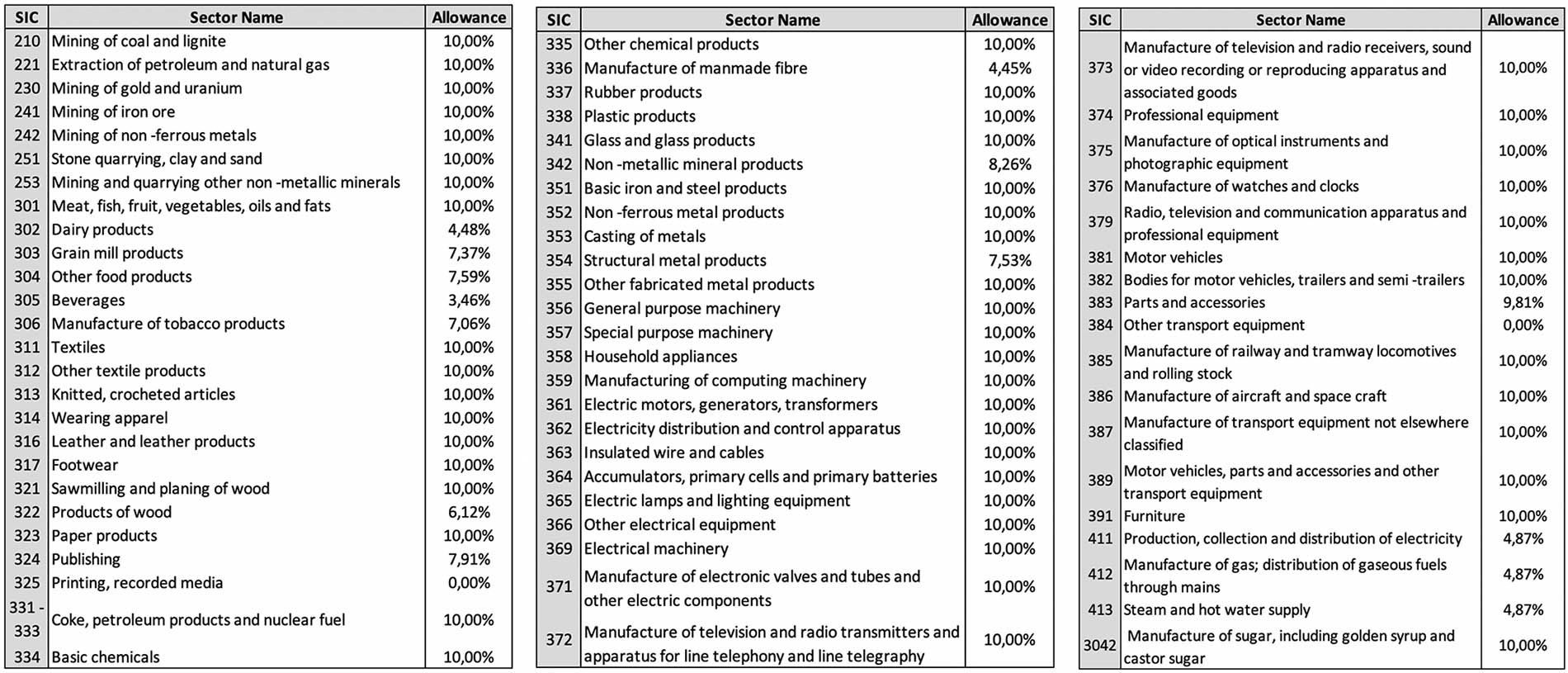

Schedule A in GN 690 lists the trade exposure allowances that are applicable to taxpayers in different sectors. Obtaining the trade exposure allowance is as simple as reading the percentage from Schedule A beneath:

The maximum percentage that a taxpayer can receive for trade exposure is 10 %. Many of the sectors listed in Annexure A are indeed allocated 10 % for trade exposure, but some sectors are not. For instance, steam and hot water supply are allocated 4.87 %, dairy products are allocated 4.48 % and wood products are allocated 6.12 %.

In the event that a taxpayer isn’t satisfied with the percentage that is allocated to their sector, i.e. sectors that aren’t allocated the maximum of 10 %, the taxpayer can calculate their own percentage for the trade exposure allowance in accordance with regulation 4 of GN 690 using the equation below to determine the trade intensity. The taxpayer would have to sum the monetary value of products that were exported and raw materials that were imported during the tax period, and divide this by the total sales for the tax period. These values would have to be verified by an independent auditor.

Trade Intensity Formula

X = (E + I)/S x Y

X is the percentage of trade intensity, E is the value of exports, I is the value of imports, S is the total sales and Y is 100

If a taxpayer calculates the trade intensity (X) to be less than 10 %, the taxpayer will not receive a trade exposure allowance. In this case the taxpayer would be better off using the trade exposure allowance in Schedule A above, which will be greater than zero. The taxpayer is permitted to use whichever method (Schedule A or the formula) yields the higher trade allowance.

(R 10 mil + R 50 mil) / R 100 mil = 60 %

which is greater than 30%, so the taxpayer would receive the full 10 % trade exposure allowance.

However, if a taxpayer exports product worth R 1.5 million, imports raw materials worth R 1 million and turns over R 10 million of sales in the period, then X would be 25 % and the taxpayer would only receive a trade exposure allowance of 8.25 % (i.e. 0.33 * 25 %).

The regulations also provide guidance for calculating the trade exposure allowance for taxpayers that export several different products, each of which falls under a different sector. However, it is intriguing to note that the average trade allowance for such a taxpayer is weighted according to each sector’s national revenue and is not weighted according to the taxpayer’s split of revenue from each sector within their business.

(Side note: Yellow Tree feels that the Trade Intensity Formula should be the absolute value of the subtraction of imports from exports and not the sum of imports and exports. This is because companies that both import raw materials and export final products, have their risk hedged and their trade exposure reduced. What do you think? Please email us and share your thoughts.)

Performance Allowance Regulations

The performance allowance regulations were promulgated on the 19th of June 2020 and were published as Government Notice (GN) 691. The performance allowance only applies to the following industries because intensity benchmarks are only available for these industries:

|

Primary production of steel |

Production of cement |

Ilmenite industry – titanium slag |

|

Production of ferrochrome |

Production of pulp and paper |

Production of quicklime |

|

Production of silicomanganese |

Refining of petroleum |

Production of sugar |

|

Mining of platinum, gold, coal |

Production of clay bricks |

Production of aluminium |

|

Production of nitric acid |

Production of ceramic tiles |

In order for a taxpayer who falls into one of these industries to determine if they qualify for the performance allowance, they would need to measure and verify their own emissions intensity and compare it to their industry benchmark. The ratio of the industry benchmark to their own emissions intensity would provide the performance allowance, according to the formula:

Z = (A/B – C) x D

Z is the performance allowance, A is the industry intensity benchmark, B is the taxpayer’s measured emissions intensity, C is the value 1, and D is 100

The regulations also provide equations for taxpayers whose activities span more than one of the industries that are listed above.

It is important to remember that a taxpayer can only receive a maximum of 5 % for the performance allowance. For instance, the intensity benchmark for primary steel production is 3.83 tonne CO2e / tonne of crude steel. If a taxpayer’s operation has an intensity of 3.63 tonnes CO2e / tonne of crude steel, then the value of Z would be 5.5 %. However, the taxpayer would only be able to claim 5 % for the performance allowance.

Offset Allowance Reglations

The offset allowance regulations were promulgated on the 29th of November 2019 and were published as Government Notice (GN) 1556. The purpose of this allowance is to permit a taxpayer to invest in a project that does not reduce the taxpayer’s CO2e emissions, but which instead reduces someone else’s CO2e emissions.

There are two occasions when it may be desirable to do this. The first occasion is when it is cheaper to reduce someone else’s CO2e emissions than one’s own.

The second occasion is when it is not possible to reduce one’s own emissions, because carbon tax is levied on the tonnes of product produced (as under Tables 2 and 3 of Schedule 1 in the Carbon Tax Act). For example, a glass manufacturer (IPCC code 2A3 of Schedule 2 of the Carbon Tax Act) would calculate their CO2e emissions by multiplying their tonnes of glass product by the IPPU emissions factor (0.2 tonnes CO2e / tonne of glass produced). When the only way to reduce carbon tax would be to reduce factory output, offset allowances provide a way of investing in someone else’s project to reduce tax instead.

Bear in mind that many taxpayers are taxed on the fuel that they consume in their process, under IPCC code 1. Fuel is an input to the business, and as such the taxpayer has control over this. The taxpayer could install more efficient equipment that consumes less fuel. The taxpayer could change to a fuel that is more efficient in combustion (e.g. from coal to LPG) and use less fuel. The taxpayer could change to a fuel that incurs less carbon tax (e.g. biomass). But conversely, a taxpayer who is taxed on the output of their business has no way of reducing carbon tax, but for offset allowances.

Offset allowances can only be claimed for approved projects that are registered as Clean Development Mechanism (CDM), Verified Carbon Standard (VCS), or Gold Standard projects. Projects that comply with other standards that are approved by the Minister of Energy may also be eligible.

In order to qualify as offset projects, these approved projects have to be executed in South Africa, on or after the 1st of June 2019, and must not themselves benefit from a reduction in carbon tax, or benefit from another tax incentive.

The regulations also specify activities that are not eligible for the offset allowance. For instance, any activities that have already received an allowance in terms of section 12 L of the Income Tax Act (Energy Efficiency) will not be eligible to receive an offset allowance. The offset regulations give a list of all of the activities/projects that are not eligible as well as a set of conditions that make a project eligible.

Carbon Budget Allowance

A taxpayer who participates in the carbon budget system during or before the tax period, receives an allowance of 5 %, provided that the Department of Environmental Affairs confirms the taxpayer’s participation in writing. Mandatory carbon budgeting comes into effect 01st January, 2023, at that time the carbon budget allowance of 5% will fall away.

Renewable Energy Allowance (for Taxpayers who Generate Electricity from Fossil Fuels)

Section 6(2) of the Carbon Tax Act includes one more allowance that has not been mentioned thus far. This Renewable Energy allowance applies only to taxpayers who are generating electricity using fossil fuels, and it is intended to incentivise these taxpayers to install renewable energy capacity and in so doing to reduce their carbon tax liability from fossil fuel firing. This allowance can be applied without having to register a carbon project and without claiming an offset allowance. The renewable energy allowance is therefore a much easier mechanism than the offset allowance. The formula is simple:

X = A – B – C

X is the final carbon tax liability, A is the carbon tax calculated from section 6(1), B is the Renewable Energy Premium multiplied by the kWh, C is the Environmental Levy on Electricity of 3.5c/kWh multiplied by the kWh.

GN 692 was passed on the 19th of June 2020 and provides the renewable energy premiums that taxpayers should use to reduce their tax liability if they produce electricity from renewable sources in addition to fossil fuel sources:

|

Renewable Energy |

Premium (R/kWh) |

|

Biomass |

R 2.09 |

|

Concentrating Solar Power |

R 4.11 |

|

Landfill Gas |

R 1.35 |

|

Onshore Wind |

R 1.23 |

|

Solar Photovoltaic |

R 2.27 |

|

Hydro < 15 MW |

R 1.61 |

|

Hydro > 15 MW |

R 0.84 |

The environmental levy on electricity of R 0.035 /kWh should also be deducted from the carbon tax.

Concluding Remarks

It is important that taxpayers remember that they have to register and license their facilities as manufacturing warehouses with their nearest Customs Branch. To learn more about this registration process please click this link. Additionally, taxpayers that are eligible for carbon tax are automatically eligible for greenhouse gas reporting and hence would also have to register with the Department of Environment, Forestry & Fisheries.

Please contact us if you have any questions or if you would like us to assist you in determining your carbon tax liability. We love serving our clients, and welcome the opportunity to help you!