10 Ways to Reduce Carbon Tax

How many did you use this year?

As the 2022 carbon tax year draws to a close with payments due by no later than the 28th of July 2023 (i.e. Friday next week!), we reflect on ways in which we have helped our clients to reduce their carbon tax this year. These methods of reduction are worth your focus in the years ahead. We thought to share them with you because enormous increases in the cost of carbon tax are imminent, as shown by the graphs in this fascinating one-page article.

Described beneath are 10 ways to reduce your carbon tax, starting with the most obvious, and culminating with some interesting and innovative options. We would love to help you implement these measures – so please do connect with us!

1. The first is the most obvious: be meticulous with your record keeping during the year. Keep clear records of all fossil fuels that were combusted, and records of which were combusted in stationary applications vs mobile applications (this is important). Also, demand fuel specification records from your suppliers frequently through the year (ideally monthly).

2. The second is equally as simple: ensure that you have a trusted partner to perform your carbon tax calculations. If you perform them yourself, have a trusted partner review them for accuracy and have them assess whether you have capitalized on all the available carbon tax allowances.

3. If your business is classified under an SIC code as trade exposed, don’t merely read the trade exposure allowance from the table (Annexure A of GN 43451, 19th June 2020), but perform a calculation using the formula that is provided. This formula makes use of your total imports and exports as a % of sales. If this method determines a higher allowance than that in the table, you may use the higher value! If your SIC code permits a 10% allowance, which is the highest available, then you don’t need to bother with this point 3.

4. Many businesses have not yet made use of the offset allowance through the purchase of carbon credits. Although the offset allowance is 10%, the price of carbon credits is often 90% of the prevailing tax rate, resulting in a mere 1% saving in carbon tax. Nonetheless, for large carbon tax bills, this may be helpful. And of course, one shouldn’t rule out the option of being resourceful and purchasing carbon credits at a lower price. But remember that only credits that are created under the Clean Development Mechanism (CDM), Verified Carbon Standard (VCS), or Gold Standard, may be retired in order to be used as offsets to reduce carbon tax. Furthermore, considering the steep increases in the price of carbon tax in the years ahead, purchasing carbon credits now for the 2023 – 2025 tax years could unlock a good return. Just remember to not purchase more credits than you think you will need for the period of 2023 – 2025. Phase 1 of carbon tax ends in December 2025 and the legislation may change after that, possibly rendering a particular type of carbon credit that you purchased, redundant.

5. You may not have used the performance allowance to date (GN 43452), which could provide you with a 5% tax deduction. We can help you calculate the performance allowance by evaluating your scope 1 and scope 2 emissions. Remember that the rest of the carbon tax formulae only calculate the stationary component of your scope 1 emissions. However, the performance allowance evaluates your full scope 1 emissions (stationary and mobile) and your scope 2 emissions (i.e. electricity usage). Strangely, not all emissions intensity benchmarks include both scope 1 and scope 2 emissions (so chat to us for clarity based on your industry). Scope 2 emissions are attributable to electricity use and to calculate these you will need to convert your annual electricity usage (in MWh) to a CO2e (Carbon Dioxide Equivalent) value, and sum these emissions with your scope 1 emissions. Having obtained your total scope 1 and 2 emissions, you divide these by your annual production in tonnes and compare your emissions intensity to the emissions intensity benchmark if one exists for your industry. If you beat the emissions intensity benchmark, you can claim the performance allowance.

6. We successfully submitted several carbon budgets to the Department of Forestry, Fisheries and the Environment (DFFE), and this saved some of our clients several hundred thousand Rand each in carbon tax this year. Our clients often ask whether a voluntary carbon budget binds the company to the budgeted value. The answer from the DFFE is an emphatic “No!”. The voluntary carbon budget system exists simply to get industry reporting on the system ahead of mandatory carbon budgeting. Mandatory carbon budgeting will only become effective once the Climate Change Bill has been promulgated. We chatted to those drafting the bill recently, and it is evident that the bill may still be some time off. Although a long shot, voluntary carbon budgets may therefore still be an effective tool for carbon tax reduction, so if you are interested, please chat to us and we can engage with the DFFE on your behalf.

7. This year was the first year that Tier 3 factors were required to be used instead of tier 1 factors. What are tier 1, 2 and 3 factors? These are the factors that are used to convert your fuel use (in tonnes, cubic meters, litres, GJ, or MWh) to tonnes of carbon dioxide equivalent (CO2e) which are emitted to the atmosphere. Tier 1 factors are global factors that were developed by the Intergovernmental Panel on Climate Change (IPPC). Tier 2 factors are country specific factors for South Africa and can be found in the 2022 Methodological Guidelines for Quantification of Greenhouse Gas Emissions which can be downloaded at the bottom of this article. Tier 3 factors are site specific and are calculated based on the fuel specification sheets of the diesel, paraffin, coal, HFO, LPG etc that is burnt in your boilers, incinerators, driers, mixers, heaters, furnaces and other appliances. Interestingly, tier 3 factors produce quite different results from tier 1 factors, particularly for South African coal. Even more interestingly, for some IPPC codes (such as 1A2e – food, beverage and tobacco industry) companies were presented with the option of choosing either tier 1, 2 or 3. Choosing the correct tier saved one of our clients ≈ R400 000 in carbon tax this year.

8. Oxidation factors: This is where it begins to get interesting. As a team of chemical engineers who perform air dispersion modelling and Greenhouse Gas (GHGs) calculations, we are always intrigued by the link between engineering and its expression in law. This year the DFFE advised that it should be assumed that all the carbon that is present in the fuel is combusted and releases CO2, CH4 (methane) and N2O (nitrous oxide) – the Greenhouse Gases (GHGs). This is a fair assumption for clean burning fuels such as gas and the cleaner liquid fuels (paraffin, kerosene, LO10, and to an extent, diesel). It is also fair to assume that almost all of the carbon in dirty liquid fuels such as heavy furnace oil (aka heavy fuel oil, or HFO) is combusted, although some carbon will be emitted as unburned cenospheres of fuel known as particulate matter (PM).

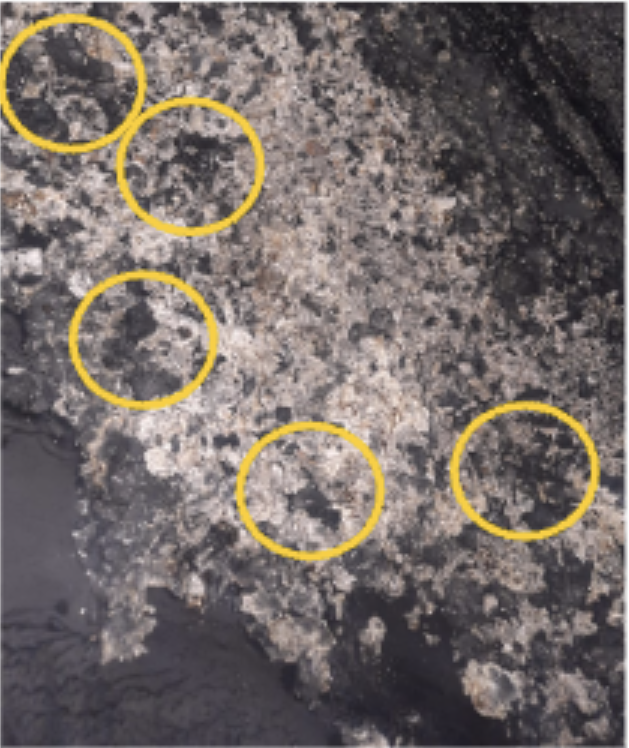

But as for coal, this is a poor assumption. Because of boundary layer theory not all of the carbon that is in coal combusts. As shown in the image beneath, black deposits of carbon remain in the ash after the combustion of coal:

For this reason, it may be possible for Yellow Tree to measure the carbon that remains in the ash at your facilities and to calculate an oxidation factor. After motivation to the DFFE, it may be possible to apply this factor, resulting in a more accurate calculation of your CO2e and lower carbon tax. We would love to help you with this next year so please do get in contact.

9. The ninth option is an exciting one – a fuel switch. For our nation and for our world to move forward, it is important to remember that carbon tax is not merely another tax. By viewing it as such, one would miss the opportunity to see the heart of the policy makers and the need of our planet. Carbon tax was promulgated to disincentivise the use of carbon heavy fuels (like coal). A switch to lower carbon fuels is intended to reduce your tax. Often lower carbon fuels are more expensive, but not always. Wood, for example, may be a cost-effective option if there is a supply near your facility. While converting to wood-firing may be capitally intensive, we have a list of suppliers that sell such equipment, have financing options and which supply wood.

Even fossil fuels like natural gas and liquified petroleum gas (LPG) are cleaner than coal. The reason is simple. Natural gas consists mainly of methane (CH4). Therefore, for every molecule of carbon that burns, four molecules of hydrogen also burn to form water which is carbon neutral. One must remember that methane has the highest ratio of hydrogen to carbon atoms and is therefore the cleanest fossil fuel.

10. We have saved the best for last! This option is a win-win-win. It is a win for you as a client, it is a win for the policy makers whose desire is to decarbonize the economy, and it is a win for the planet. This option is also inexpensive. It is the application of bespoke engineering skills to your energy plant to optimise its efficiency and in so doing to reduce your fuel usage and extend the life of your plant. You win because you pay less carbon tax and greatly reduce your fuel bill. We perform isokinetic stack sampling and flue gas analysis on hundreds of combustion stacks every year, and it is very seldom that we see combustion plant in South Africa operating anywhere near its optimum. There exists a large gap. There are many companies that can assist you either by auditing your plant, or by upgrading your combustion control systems, or even by operating the energy plant on your behalf. We keep these suppliers at arms length, but do keep a list that we will gladly share with you. It is our hope to share this list as a future article on our website.

Those are 10 great ways to reduce carbon tax in 2023. If you would like us to review your carbon tax calculations before you release payment of your 2022 carbon tax next week, it is not too late. Please connect with Cait, Sasha or Sean. We would love to help you.